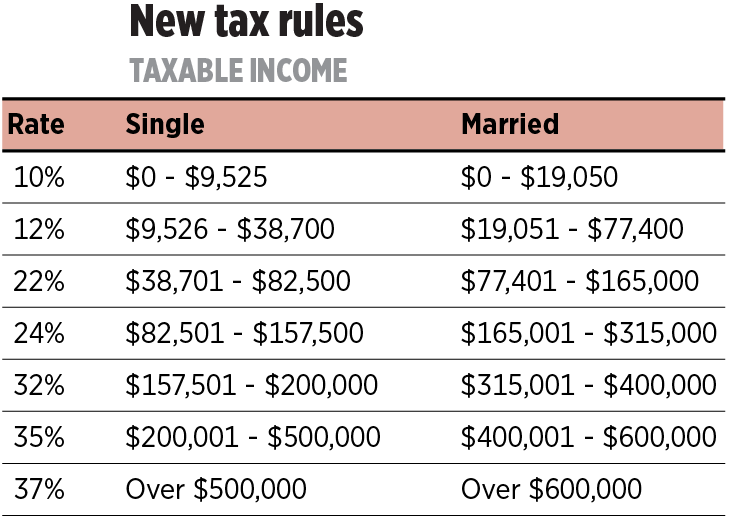

The new inflation adjustments are for tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. However, with the Tax Cuts and Jobs Act of 2017 (TCJA), the IRS now uses the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly. ” Bracket creep occurs when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income. Many tax provisions-both at the federal and state level-are adjusted for inflation. To prevent what is called “ bracket creep Bracket creep occurs when inflation pushes taxpayers into higher income tax brackets or reduces the value of credits, deductions, and exemptions. Bracket creep results in an increase in income taxes without an increase in real income.

It is sometimes referred to as a “ hidden tax,” as it leaves taxpayers less well-off due to higher costs and “ bracket creep,” while increasing the government’s spending power. The same paycheck covers less goods, services, and bills. Department of the Treasury and is responsible for enforcing and administering federal tax laws, processing tax returns, performing audits, and offering assistance for American taxpayers.Īdjusts more than 60 tax provisions for inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. On a yearly basis the Internal Revenue Service (IRS) The Internal Revenue Service (IRS) is part of the U.S.

0 kommentar(er)

0 kommentar(er)